Riverina East Project

(formerly First Hit Gold Project)

High-grade Inferred Mineral Resource Estimate (MRE) of 83.8k tonnes at 7.0g/t Au for 19.0k ounces (JORC 2012) with significant regional potential.

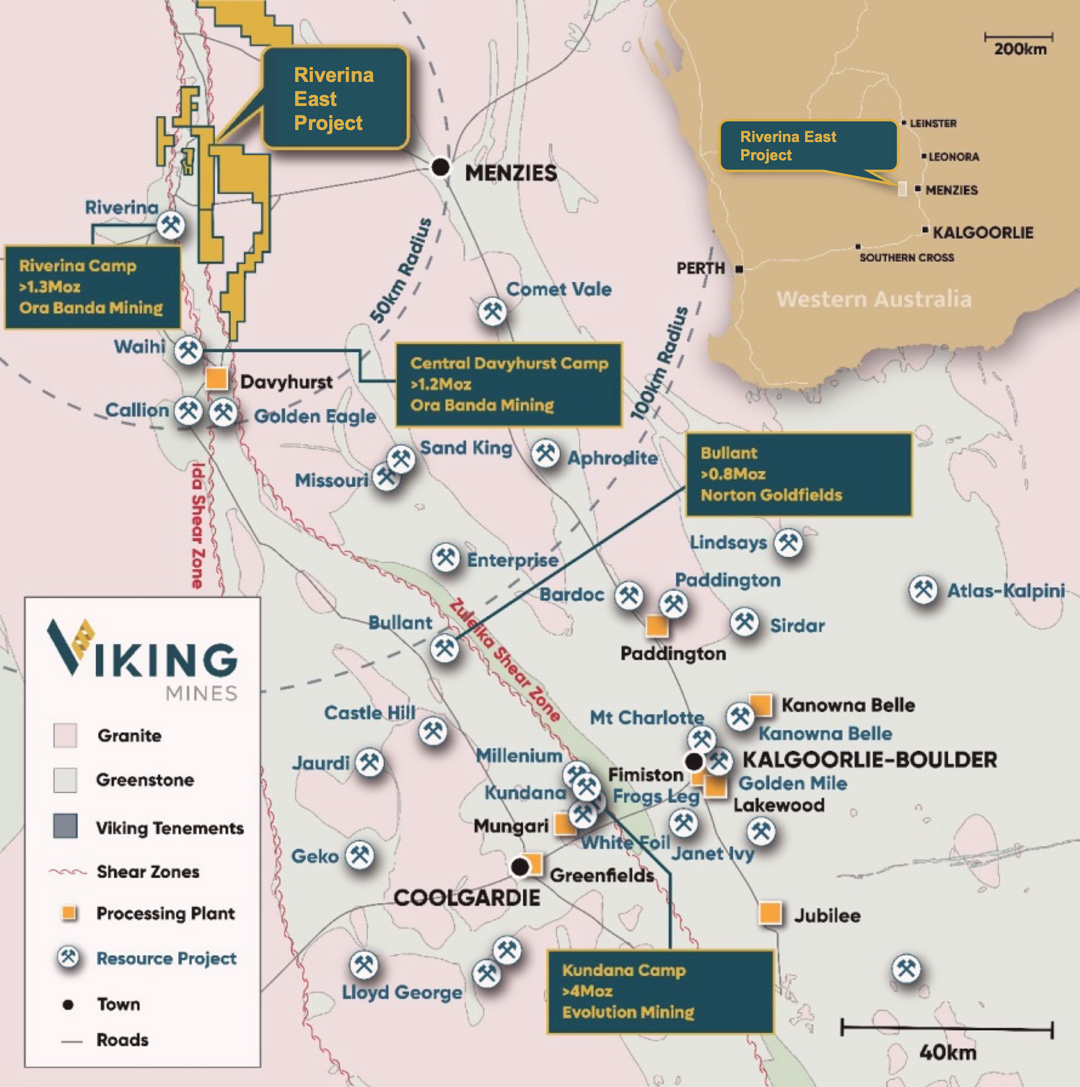

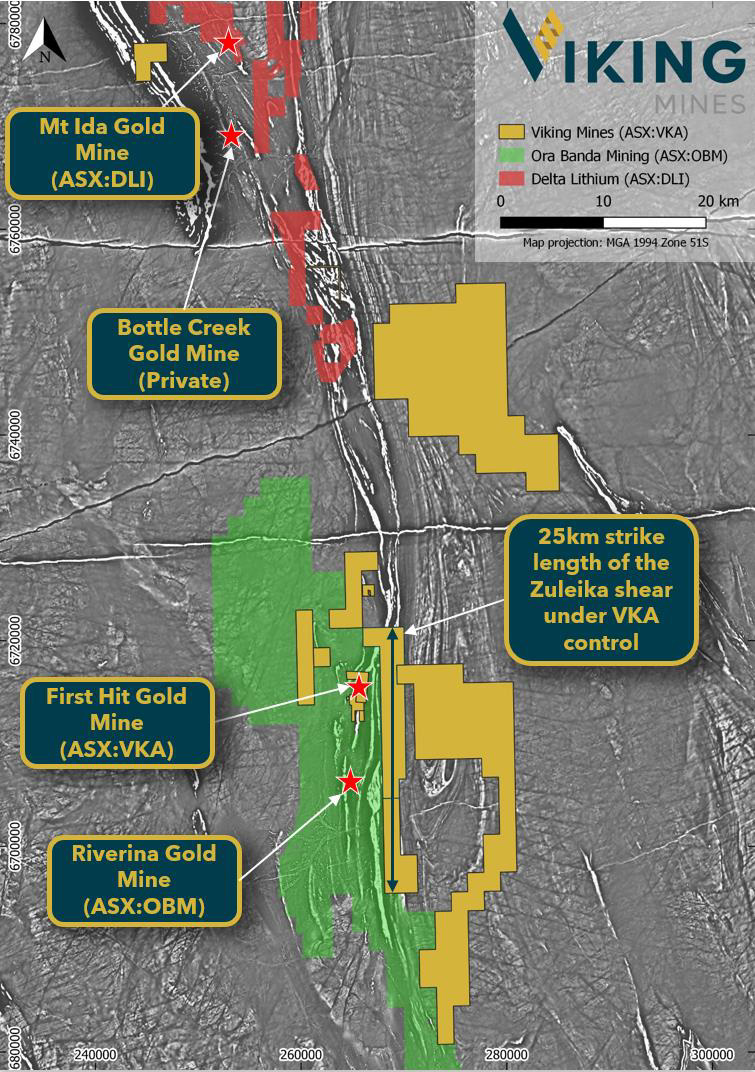

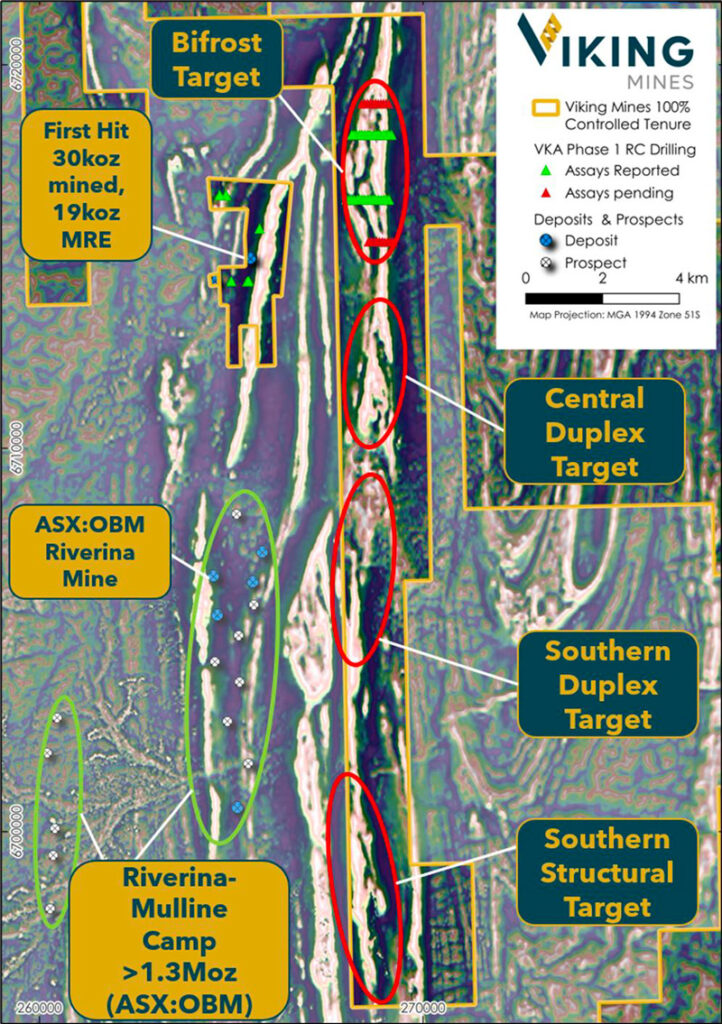

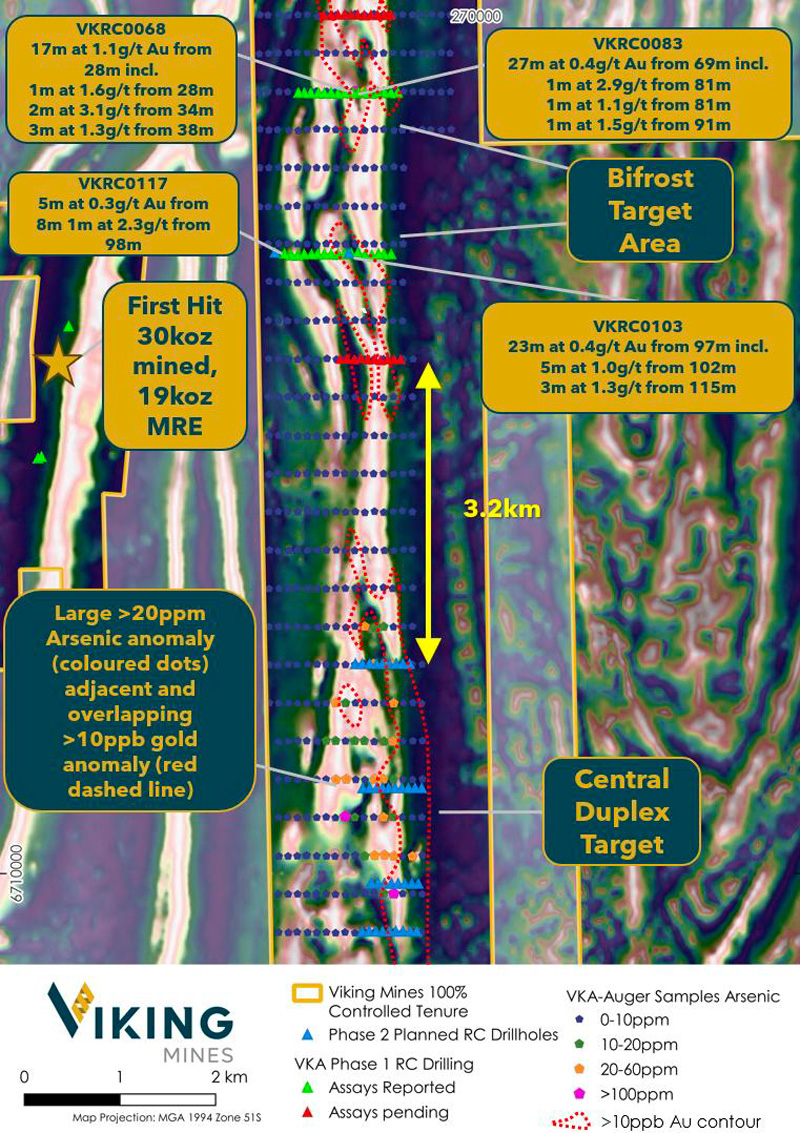

The Riverina East Project is centred around the historic high-grade First Hit gold mine situated along the prospective Ida and Zuleika Shear zones in the Eastern Goldfields of Western Australia. Viking controls over 25km strike of the prospective Zuleika Shear and has been using geophysics, auger and reverse circulation drilling to narrow the focus to highly anomalous target zones.

The First Hit gold mine was operated by Barra Resources in 2002 and at a time of depressed gold prices of US$320/oz, or approximately 10% of the current gold price.

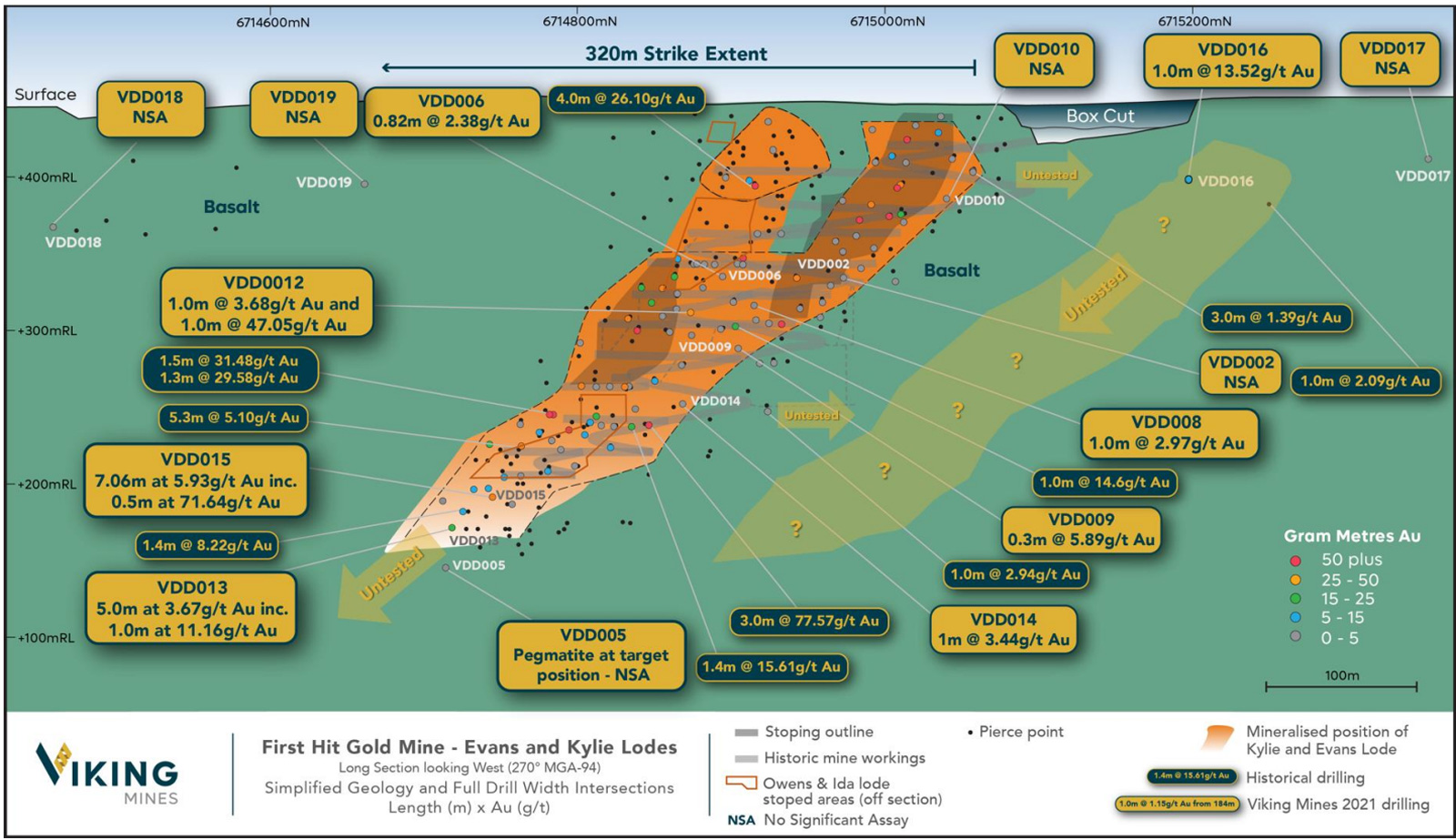

The First Hit mine produced ~30koz ounces of gold at an average grade of ~7.7g/t Au. There was a prolonged period of no modern exploration activity, which created a significant opportunity for Viking. The Company is focused on delivering exploration programmes to test near mine extensions and regional targets around the Riverina East Project with the objective of defining fertile structures and discovering gold ounces.

The Project area is well serviced by infrastructure and is located 50km west of the sealed Goldfields highway and the township of Menzies.

The nearest operating gold processing plant is the Davyhurst Mill 50km to the south, owned and operated by Ora Banda Mining (ASX:OBM). The nearest operating gold mine is the Riverina open pit, located 8km south of the First Hit gold mine, also owned by OBM.

Underground Mining Study

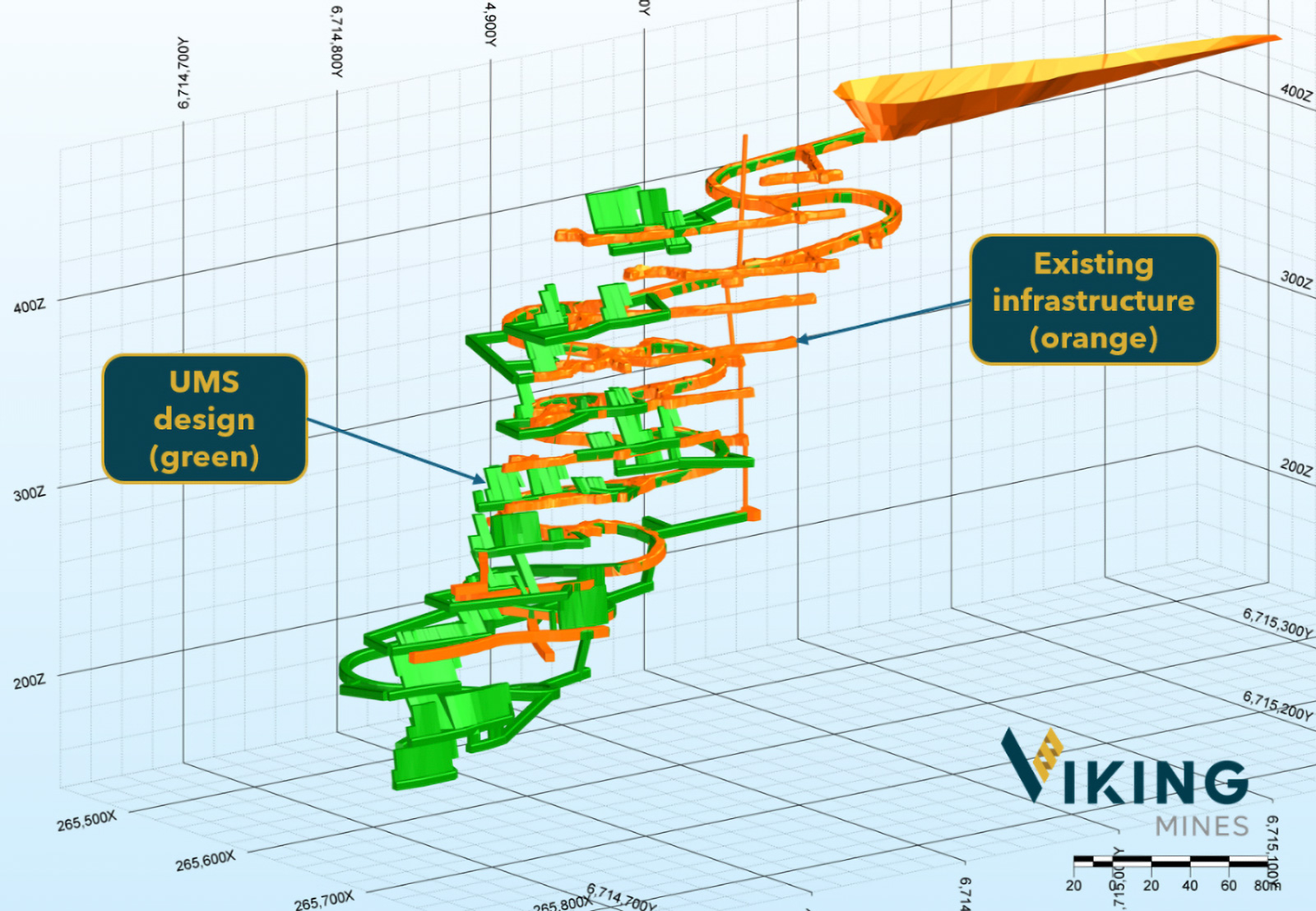

Viking is undertaking an analysis of the gold production potential at First Hit, assessing the remnant stopes using current gold price and operating costs. Whilst the tonnage may be modest, the value of mining it may be potentially significant for Viking given the current extremely strong gold price. Underground development would also open up the potential to more cost effectively test depth extensions from underground drill positions.

The Company engaged an external engineering consultancy that specialises in underground mine design and evaluation to assess the First Hit Global Inferred (JORC-2012) MRE of 83.8k tonnes at 7.0g/t Au for 19.0k ounces.

The output from the study delivered an in situ Inferred Mineral Resource (JORC-2012)of 53.1kt at 7.2g/t Au for 12.4koz gold (above a 1.3g/t Au calculated stoping cut-off grade), representing 65% of the global mineral resource estimate.

Cautionary Statement: The Underground Mining Study referred to in this report is based on low-level technical and economic assessments and is insufficient to support estimation of Ore Reserves or to provide assurance of an economic development case at this stage, or to provide certainty that the conclusions of the Underground Mining Study will be realised. For avoidance of doubt, the stated MRE determined by the UMS is the in situ Mineral Resource and this announcement does not contain any forecast financial information and does not include a Production Target.

A detailed series of steps were undertaken to establish the portion of the Global MRE that could be extracted under defined assumptions for mining engineering parameters, geotechnical conditions, dewatering parameters, processing recoveries, operating costs and gold price. It was assumed that the same mining method of sub-level open stoping would be employed as was used successfully when First Hit was previously in operation in the early 2000’s. These assumptions (Table 1) were used as the inputs into Deswik SO software to generate a set of stope shapes. These stope shapes were then manually assessed and a mine design completed (Figure 1) to extract the maximum mineral resource with a positive cashflow. These assumptions will need refining when further information becomes available and as the study level progresses.

| Category | Assumption | UoM | Value | Comments |

| Financials | Gold Price | A$/oz | $4,500 | Current gold price with ~14% discount |

| Royalty | % | 2.50% | Western Australia state royalty | |

| Gold selling price | A$/oz | $4,383 | Gold sale price after refining costs and state royalty | |

| Discount Rate | % | 8% | ||

| Mining Parameters | Underground Mining Cost | A$/t | $89.13 | Derived from multiple company financial reports operating in the region |

| Ore Drive Dilution | % | 5.00% | Industry standard for deposit type | |

| Mining Recovery | % | 95.00% | Industry standard for deposit type | |

| Processing Recovery | % | 94.50% | Derived from historical production data from First Hit | |

| Incremental Stoping Cut-Off grade | g/t Au | 1.3 | Calculated | |

| Minimum stoping width | m | 2m | Established viable mining width employed at Riverina |

Table 1: Input assumptions used in Deswik SO software to determine minable stopes for mine design

Significant Gold Potential

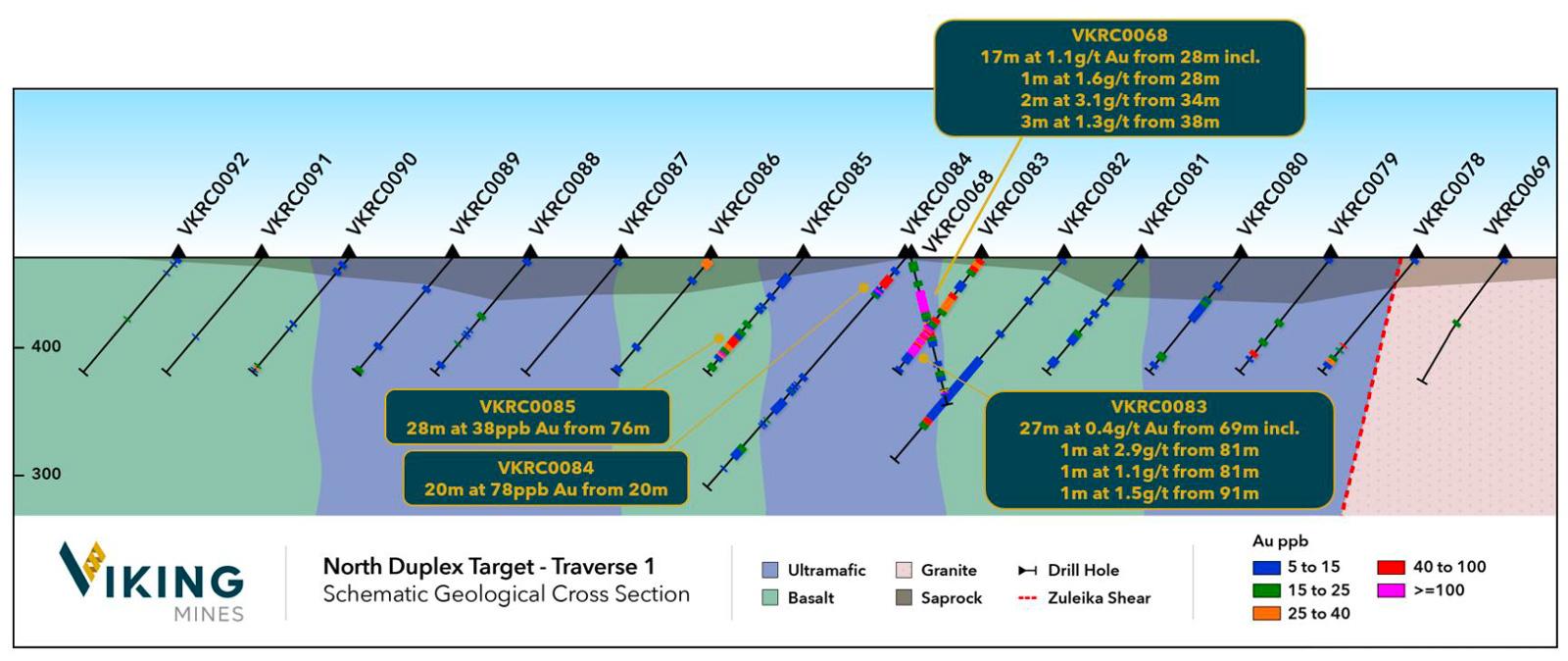

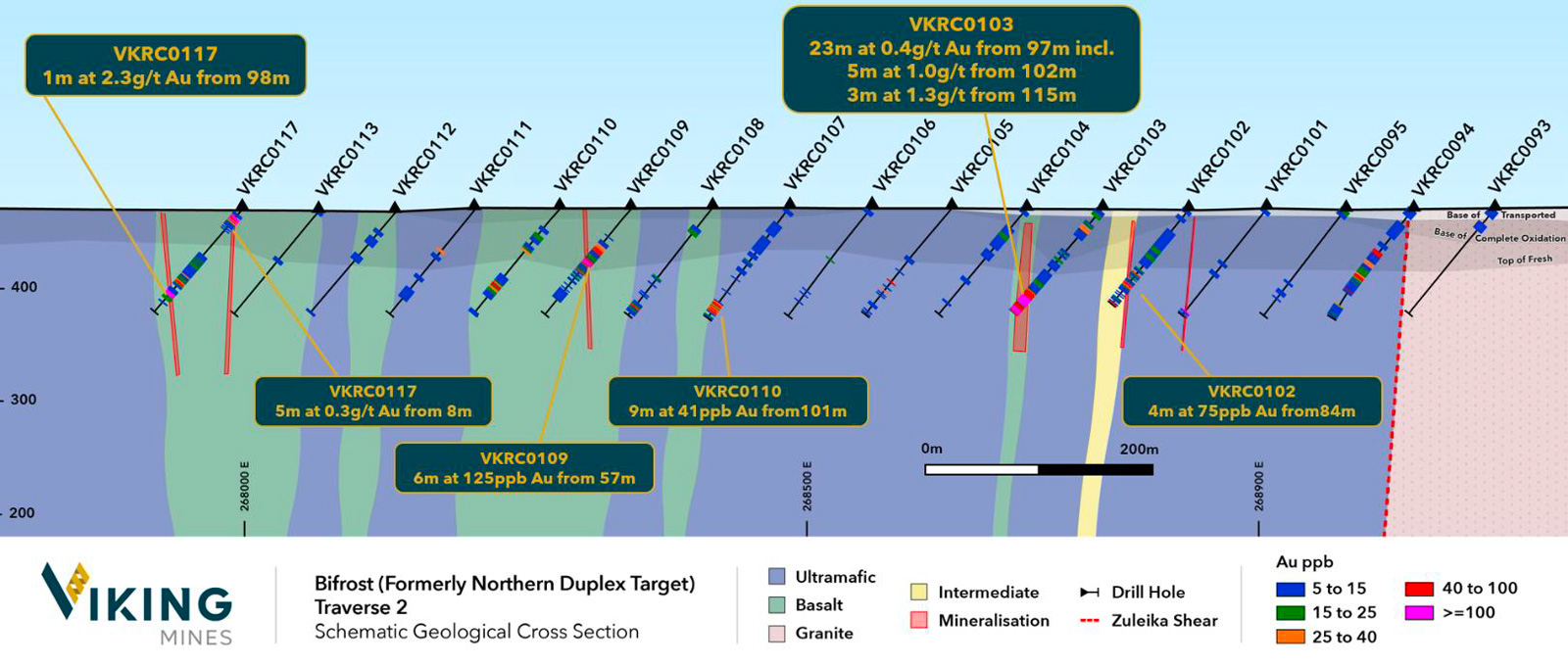

Viking Mines completed extensive gold focussed drill programmes across the Riverina East Project area in 2021, which included ~3,900m of Diamond Drilling, ~5,000m of Air core and ~6,700m of Reverse Circulation drilling. The focus of these drill programmes was to identify narrow-vein, high-grade gold shoots, with a goal of replicating the high-grade shoot of the historic First Hit Gold Mine.

Standout intercepts from the various drill programmes testing extensions to the historic mine workings include:

- VDD013: 5.0m at 3.67g/t Au including 1.0m at 11.16g/t Au

- VDD015: 7.06m at 5.93g/t Au, including 0.5m at 71.64 g/t Au

- VDD016: 1.0m at 13.52g/t Au

2025 Exploration Priorities

The Company has identified a 25km strike extent of the Zuleika Shear to the east of the First Hit Mine. The Zuleika Shear is a prolific gold structure within the Eastern Goldfields of WA with numerous gold deposits related to it.

The Company is systematically using geophysics, auger drilling and RC drilling to focus in on potential target zones. Drilling in late 2024 and early 2025 has identified mineralised structures at the Bifrost Prospect, Central Duplex Target, Southern Duplex Target and Southern Structural Target that it intends to drill in 2025.

Lithium Prospectivity to be assessed as prices improve

The Riverina East Project is also highly prospective for lithium. In a previous 1,220 hole auger programme, Viking defined nineteen targets, with a peak value of 138 ppm Li encountered. However, the Company is currently prioritising gold exploration at the project with a view to revisit the lithium targets when lithium prices improve.